Having an Offset feature as part of your home loan package can be a fantastic tool if utilised correctly.

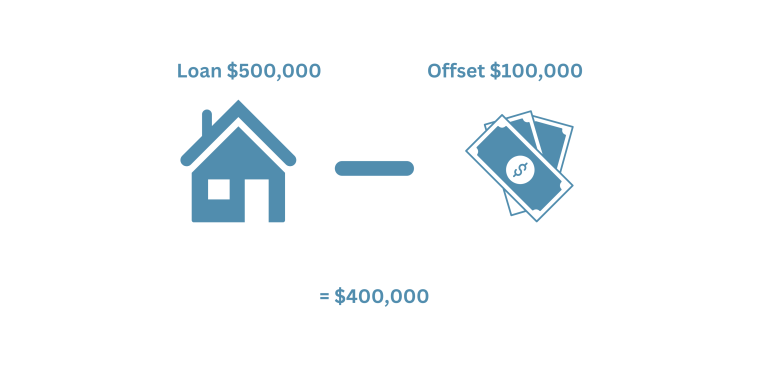

The concept is simple. Any funds in your Offset are deducted off the total loan balance each day when the bank calculates your interest payable.

The more you have in your Offset account, the greater the benefit. So you may choose to have all of your savings plus your salary credited to the Offset.

It’s important to understand the pros and cons of this strategy and how it fits with your unique style of financial management.

The benefits:

- Money stored in your Offset account will save you interest and more of your repayments will go towards reducing the principal – paying off your loan faster.

- Money stored in your Offset saves you interest on your home loan but does not earn interest like a normal savings account would. If you were earning interest instead of saving interest, it might be considered taxable income (refer to your Accountant).

- Money stored in your Offset is easily accessible at any time and can be used for any purpose you see fit.

- If your property is an investment, or you intend to convert your property into an Investment in the future, you may choose to keep the principal higher to maximise tax deductibility (again refer to your Accountant).

The drawbacks:

- Keeping all your savings in one spot to maximise the effectiveness of your Offset can muddy your budget as it can be harder to track your spendings.

- Keeping all your savings in one spot, and having easy access via internet banking and debit cards, may increase your chances of cyber safety issues.

- Offsets can come with higher fees and interest rates than a basic loan product, so if you’re not utilising the features to make it worthwhile consider a switch to a basic product instead.

- Usually only available on Variable Rate loans apart from a select few lenders who offer Fixed Rate loans with Offset facilities.

Don’t be fooled by advice from well-meaning family, friends or finance blogs that Offsets are a must-have feature. As with all mortgage advice, it should be specifically tailored to your circumstances and there is no one-size-fits-all when it comes to features.

The credit card strategy

The credit card strategy goes hand in hand with the Offset strategy. The concept is that you plonk all your savings and salary credits into the Offset account, and then use a credit card for your day to day expenses which you then pay off in full at the end of the month. The benefit being that your Offset balance stays higher for longer and therefore provides further interest savings.

While technically true, unless your monthly expenditure is quite high, you’re not going to notice a huge benefit. It is more likely, unfortunately, that you will overspend or not stick to a budget as closely if you are relying on this method.

Everyone’s money mindset is different, so you really need to understand your strengths and weaknesses before diving into a strategy that can have minimal benefit.

Chat to your Broker about the pros and cons of Offsets and see how it fits into your plan.